The new Marketing Technology Supergraphic 2024 is out!

Download the clickable PDF here, or sign up for free on MartechMap.com to search, filter, and sort the 14,106 Martech vendors.

Updating the landscape is not just a logo-collecting hobby. It is a mean to a bigger research end. With 467 Martech experts and enthusiasts, we want to develop a deep understanding of what is happening in the Marketing Technology (Martech) space. By studying the landscape we gain insights that help the Martech community to do a better job.

The results of our research land in our State of Martech 2024 report You can download the report here for free.

This year there are three insights that, we believe, are shaking Martech space to its core.

The insights debunk some deeply rooted conventional wisdom in Martech. Helmets on. Brace yourself!

Let’s summarize our key findings.

- Consolidation is not a strategy

Martech growth outpaces Martech consolidation. - Composability is not a strategy

It is the daily reality. It is business as usual. - Driving Stack Value is the strategy

One metric to see where to invest and divest.

1. Consolidation is not a strategy

This year we reached a record number of 14,106 vendors on the marketing technology landscape, but that is not the only record.

This year, we reviewed 12,919 new candidate websites, exceeding the 11,038 total from the 2023 Supergraphic. Typically, we validate about 50% of the previous year's total number of tools, but it was an astonishing 127% in 2024. Kaboom.

Another record is the growth rate of 27.8%. It is the steepest growth in the last 13 years. One more record deserves mentioning, the number of tools removed was 263 tools. That churn rate of 2.1% is probably the lowest in years.

As impressive as those record-breaking numbers might be, what gives? The records aren’t perhaps interesting if we didn’t keep hearing the same conventional wisdom every year. Every year people ask us the same question.

“Will the Martech market consolidate any time soon?

This growth clearly can’t go on forever.

It is simply not sustainable.”

~conventional wisdom I

Our question normally is: “Not sustainable for who, the vendors or the stack owners?”.

If we ask the vendors they would respond that they are making a living or else would (decide to) go out of business. A handful of clients can be enough to be viable, if not profitable.

“Not sustainable” for the Martech stack owners then? Maybe. We suspect there is a hidden psychology behind expecting Martech to consolidate. Hoping the market consolidates into a handful of tools that do it all for marketing, will make choosing tools for the company stack so much easier and less stressful, wouldn’t it? Let the large vendors do the job for you in selecting the right modules and features.

A similar dynamic of relying on the advertising companies we see at play in the deprecation of 3rd party cookies. Many brand owners relied on the big tech giants to serve well-seasoned audiences. The 3rd party cookies deprecation forces brands to develop an internal 1st party database and corresponding Martech.

We do not say consolidation is not happening, but it happened at a very modest rate. So modest, that the YoY Martech growth outpaces the Martech consolidation. We also do not say that consolidation will never happen. It simply hasn’t happened (yet) for over a decade now.

So it is safe to suggest that “consolidation is not a strategy” for Martech. Waiting for that “One-Tool-That-Does-It-All-For-Marketing” is taking much longer than the targets you have to reach this year. So, shall we send the myth of the “One-Tool-That-Does-It-All-For-Marketing” to the Martech Museum? You can still visit it there but do not invite it back into your office. Deal?

Composability is not a strategy

If the market does not consolidate the Martech stack for us, then let’s consolidate the company stack ourselves.

“We need to consolidate our Martech stack.

It makes no sense to have two tools that do the same.

Duplication of solutions and features is expensive and hard to govern.”

~conventional wisdom II

It may make no sense, but the surprising results of our recent composability survey (2024 February/March) show a whole different reality. The survey results show four good reasons to duplicate features in a stack. Bare with us.

168 participants regard one Martech platform as the center of their stack, e.g. such as CRM (32%), MAP (26%), or CDP (16%). Respondents regard a platform as the “center” of their stack when more than 50% of the apps of their stack are integrated with it.

A poignant result is that a measly 4.2% regard their Multi-product suite as the center of their stack. Perhaps the respondents see a CRM or MAP module in their Multi-product suite as the center of their stack. That implies that in reality Multi-product suites are used in a composable way.

A staggering 82.7% of the respondents use alternative apps instead of the built-in features of their center platform, e.g. SMS messaging. That percentage is so high it suggests it is not an accident.

It looks like features are duplicated by design. Even more so if we consider the reasons why they duplicate features. Features are duplicated in stacks because of better functionality, experience, lower costs, and governance. Wait, aren’t those four the same reasons for consolidating all marketing technology into a “One-Tool-That-Does-It-All-For-Marketing”?

When you talk to practitioners you’ll find plenty of good reasons to duplicate features. It is not a mistake. It is a best practice. It is by design.

Companies do feature duplication for better

- Functionality

Specialist apps often have a unique functionality depth. For one vendor it is not feasible to build a product that is everything for everyone. - Economics

The price of a new multi-product module can be higher than that of a highly specialized and commoditized specialist app. If the module has been purchased already then the costs of a roll-out (configuring, integrating, and training) often exceed the costs of a turnkey out-of-the-box specialist app. - Experience

The extreme focus of the specialist apps allows them to drive supreme customer experiences due to their hyper-focus on one Job-To-Be-Done. - Governance

Introducing new features to the central platform can affect its existing functions and use cases. Often, it's not beneficial to make these changes prematurely, as marketing requires an environment to experiment first before determining what best serves the client. Only after these new capabilities prove profitable should we consider integrating them into the central platform.

All these insights point to “Composable Martech Stacks”. “Composability” has become the buzzword in Martech over the past years. We hear about composable CDPs. Composable DXPs. Composable commerce. Our take on the concept of the compostable stack is pretty straightforward. It lets you combine things to create something new. The quintessential metaphor is Lego blocks.

The Martech Lego blocks consist of a couple of center platforms that function as a sun of the solar system with branches of planets and moons in the shape of a multitude of apps.

Based on our findings in the composability survey 2024 we believe it is fair to state that composability is not a strategy, it is a daily reality. It is great that composability drives efficiencies, such as better functionality, economics, experience, and governance.

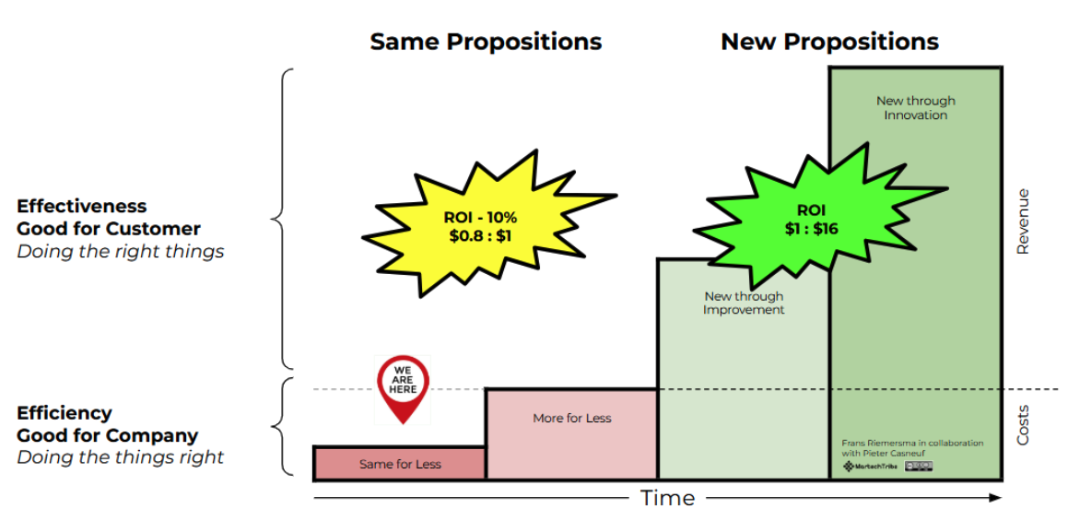

Driving Stack Value is the strategy

Efficiency is great, but effectiveness is better. Greater efficiency is about saving money, often with a focus on the company. Better effectiveness is about making money, often with a focus on the customer.

“Our Martech is far behind compared to the industry.

Our Martech maturity has to grow across the board to stay relevant.

We are not getting value from our Martech stack”

~conventional wisdom III

“Are we getting value from our Martech stack?” is the right question. Many marketing departments can demonstrate campaign ROI, ROMI, and marketing attribution. But can we tell when Martech is bringing home the bacon? Until recently, we couldn’t. Today we can tell how and when Martech drives value for a company. After years of research, we found a metric that links company value with specific Martech in stacks!

For the past 5 years, we have investigated the interplay between revenue, headcount, industry, business model, and specific Martech components. The metric correlates the company revenue-per-employee ratio and Martech maturity. It is only a start, but it is already very promising, and insightful when we apply this metric by Martech category and industry.

The formula of the metric is a correlation of internal and external performance.

- We measure internal company performance by tracking the Martech maturity. Our maturity model is a Likert scale that follows the Capability Maturity Model from Carnegie Mellon University.

- We measure the external company performance by looking at the revenue/employee ratio.

- By correlating the two we can tell when increasing the maturity correlates with an increased company value, and when not.

If we focus on the outperformers, we see the impact of their investment or divestment decisions. Outperformers are the top 30% ranking companies in one industry based on their revenue-per-employee ratio. This does not imply that you should blindly copy & paste their stacks. But the benchmark gives direction to your Martech investment decisions.

One of the surprising insights is that increasing Martech maturity does not always drive Business Value positively. This explains why some Martech works wonders in some industries and suffers from poor results in other industries.

Comparing positive and negative correlations of high- and low performers in a certain industry leaves us with a simple matrix. The matrix for Banking and Financial Services stacks positions different Martech in one of the four quadrants, each requiring a different approach to drive value.

- Quadrant 1 - Both out- and low performers show a positive correlation between maturity and improved revenue/employee ratio. Martech in this quadrant can be called ‘High Flyers’, rolling solutions out and reaping the benefits is a relatively straightforward exercise.

- Quadrant 2 - Outperformers show a positive correlation, but when low performers increase their maturity their revenue/employee ratio decreases.

Martech in this quadrant requires some homework before rolling it out, e.g. aligning goals, defining KPIs, use cases and key requirements, and growing skills. - Quadrant 3 - Outperformers show a negative correlation, but when low performers increase their maturity they improve their revenue/employee ratio.

This Martech has a positive impact initially, but less so when the company revenue/employee ratio improves. - Quadrant 4 - Both out- and low performers show a negative correlation between maturity and improved revenue/employee ratio. This does not mean you should avoid this Martech at all costs. Take CRM for instance in this industry. 73% of the outperformers have a CRM in place and did not choose to get rid of it. This implies they use it in a piecemeal fashion on purpose. It is what we could call a “Negative Satisfier”, i.e. it is required Martech, but comes with an over-engineering hazard.